Price gouging ? It doesn't exist.

I would expect this sort of thing in a socialist rag like The Age, but not The Australian: The cartoonist is clearly sympathetic to China's proclamations that it will cap the price it pays for Australian iron ore. Price caps, just like quotas or tariffs, are protectionist tools. They limit trade between two countries, usually implemented by a government to protect its own industries and harm their own consumers.

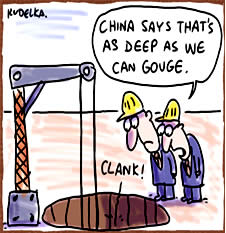

The cartoonist is clearly sympathetic to China's proclamations that it will cap the price it pays for Australian iron ore. Price caps, just like quotas or tariffs, are protectionist tools. They limit trade between two countries, usually implemented by a government to protect its own industries and harm their own consumers.

The economist David Ricardo proved the comparative advantages of international trade. Nobody in their right mind should support the Chinese government putting a cap on the price its companies can pay for Australian iron ore. Whats worse is the cartoonist has spun the issue as some sort of anti price-gouging mechanism.

What is price gouging ? Well its supposed to refer to when firms pump their prices up as high as possible, at the expense of the consumer. Even though many Western governments have laws against it, it should be no crime at all.

In the anticipation of Hurricane Katrina, many Lousiana residents tried to flee New Orleans, most of them by car. The demand for petrol obviously skyrocketed, but the supply was much the same. With this new demand, the price in a free market should be allowed to adjust upwards to allow supply and demand to meet. But the US has anti price gouging laws, meaning that any gas station owners suspected of raising their prices due to the increased demand could be prosecuted and fined. Even though there were mile-long queues of cars to each gas station, the prices weren't allowed to increase. So obviously all the stations sold out of their gas at the lower prices, even though there will thousands of willing customers who wanted to buy more gas at that price.

Does anyone see how unfair this law is yet ? The way I see it, in a free market, if you are a business owner and are smart/cautious enough to anticipate future events, you should be able to reap the rewards. If I open a lemonade stand with and dont try to predict future demand, I could suffer massive losses. For example, opening a lemonade stand in the middle of a ski resort is stupid, and my business deserves to suffer. But if I open a stand selling hot soup near a city train station in the middle of winter, thats a lot smarter and I should be rewarded for my timing and my correct evaluation of consumer demand.

Similarly, if I am a gas station owner, and I anticipate a massive surge in demand, and I own a commodity that is considered extremely valuable, why shouldn't I raise my prices so that demand can be met ?

If I only have enough petrol for 500 cars, but there are 2000 cars queueing outside, why can't I double the price in the short term ? That way, those that are willing to pay the most for petrol, those that need it the most, might be willing to pay 10 times the price because they need it that badly. But there may be people who don't really need petrol that much, its just that they are only willing to buy it at previous price levels. Well.. the point is that there is a diverse market out there, the only way to satisfy that market is to let prices adjust. They show customers that there is a shortage of petrol, at least in the short term, and that they should try and conserve as much as possible and don't buy anymore unless its desperately needed.

|